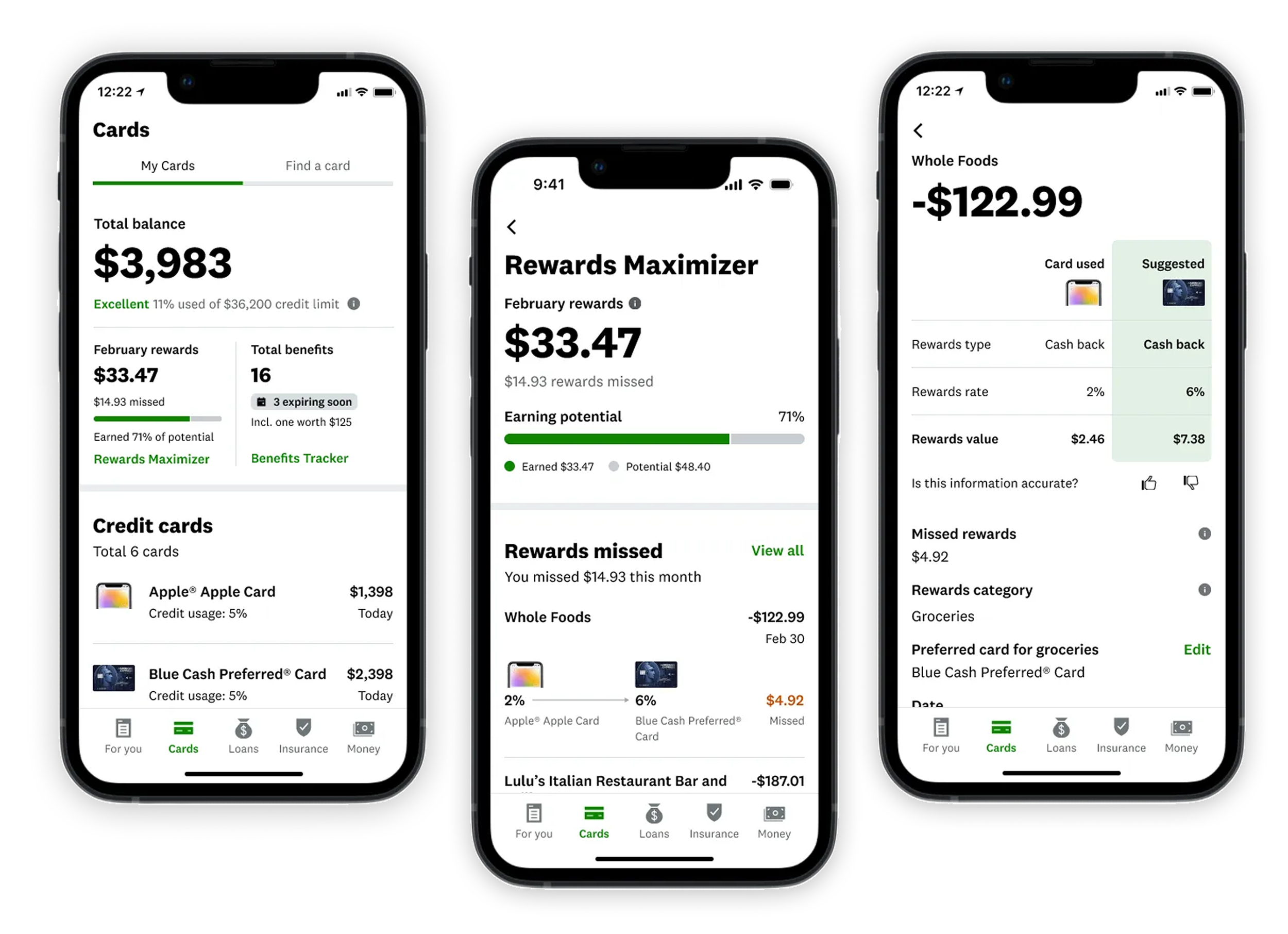

Rewards Maximizer

In 2023, Credit Karma Prime members (720+ credit scores) engaged with the credit cards surface less frequently than sub-prime members.

I worked on a high-visibility initiative to re-engage Prime members by designing card experiences that encouraged bank account connections and increased repeat visits.

The problem

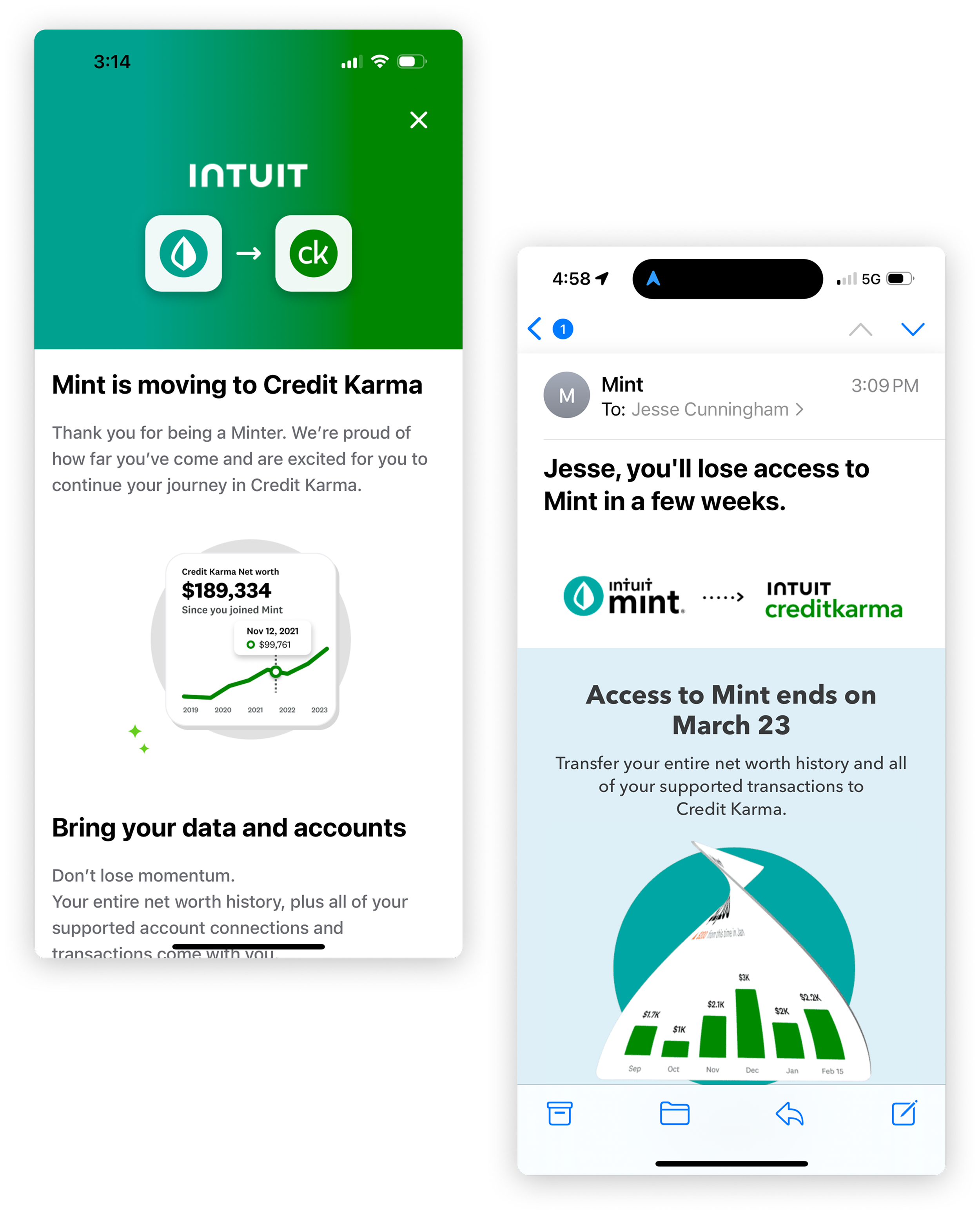

At the time, Mint was being ramped down, resulting in an influx of former Mint users into Credit Karma. These users tended to fall into what we defined internally as “Prime” members—individuals with credit scores of 720+, higher incomes, and more established financial profiles.

From tradeline data, we found that Prime members were disproportionately opening credit cards off of Credit Karma compared to subprime members. Business leadership saw this as an opportunity to engage with, and untimely increase “share of wallet” with this Prime member segment.

The opportunity was not simply to surface more credit card offers, but to help Prime members make confident, informed decisions in a category where they already had options and higher expectations around rewards, optimization, and transparency.

The challenge

Our goal was to increase engagement metrics in the prime member segment by building experiences that appeal the prime members.

Hypothesis

We believe that…

Building engaging credit card experiences targeted towards prime members

will result in…

Increased bank account connections

Increased return visits to the credit cards surface for prime members

which will ultimately…

Increase Credit Karma’s share of wallet in the prime member segment

My role

I led the design effort on this project in collaboration with a Content Designer. I was responsible for all aspects of the design process from problem discovery to assisting with QA via dogfood testing.

This feature started ramping up in-product mid 2025 and a version of it should be ramped to 100% as of this writing.

Building deep empathy

Interviewing members

I conducted 15 interviews with participants and grouped them in to corresponding themes. Each of the participiants were sorted based on their behaviors:

Non card optimizer

Uses debit card and occasionally uses a credit card for “emergencies”. Thinks of credit card debt as bad even if paid off in full every month

Simple optimizer

Spends on one or two credit cards every month. Assigns a meaning for each card (i.e. one card for Amazon and another for everything else)

Rewards chaser

Has 5 credit cards. Has some strategy for how they use their cards. Has notes on their phone on different rotating categories or special offers

Rewards maximizer

Has 10+ credit cards. Knows exactly which card to use for every purchase. Has a laminated binder with all their cards in it. Gamify’s credit card rewards

Prime member persona’s

I then created prime member persona’s based on the behavior groupings from the interviews

In collaboration with Product leadership we decided to pursue credit card rewards maximization as the topic of our design sprint. Each opportunity is framed as an “I”statement as follows.

Desired Product outcome: Increase the number of return visits to the MyCards surface

Large opportunity: “I want to maximize the rewards I earn on my credit cards”

Smaller opportunities:

I wish I could earn more credit card rewards

I wish there was a way to know if I’m getting the most rewards possible from my purchases

I wish there was a way to know which card to use before making a purchase to get the most points

Picking an opportunity

How might we..

How might we make it easy for members to maximize their credit card rewards?

Going broad to go narrow

I kicked off this project by facilitating a design sprint. I wanted to give a change for our cross functional partners an opportunity to give their thoughts and vote on a solution.

Rapid experimentation

After brainstorming and sketching we added the concepts to a Figma prototype to get feedback from prime members

Winning concept

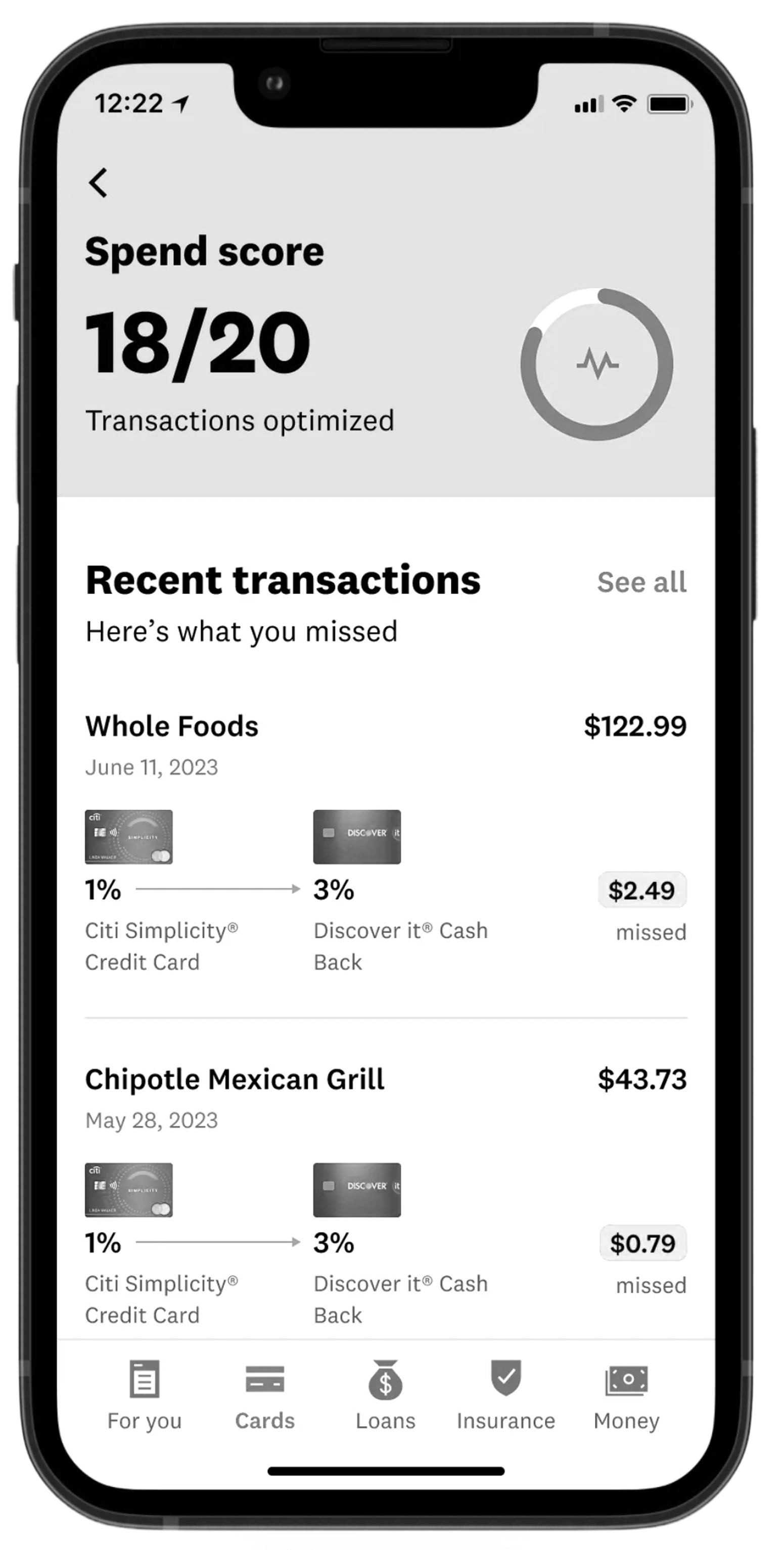

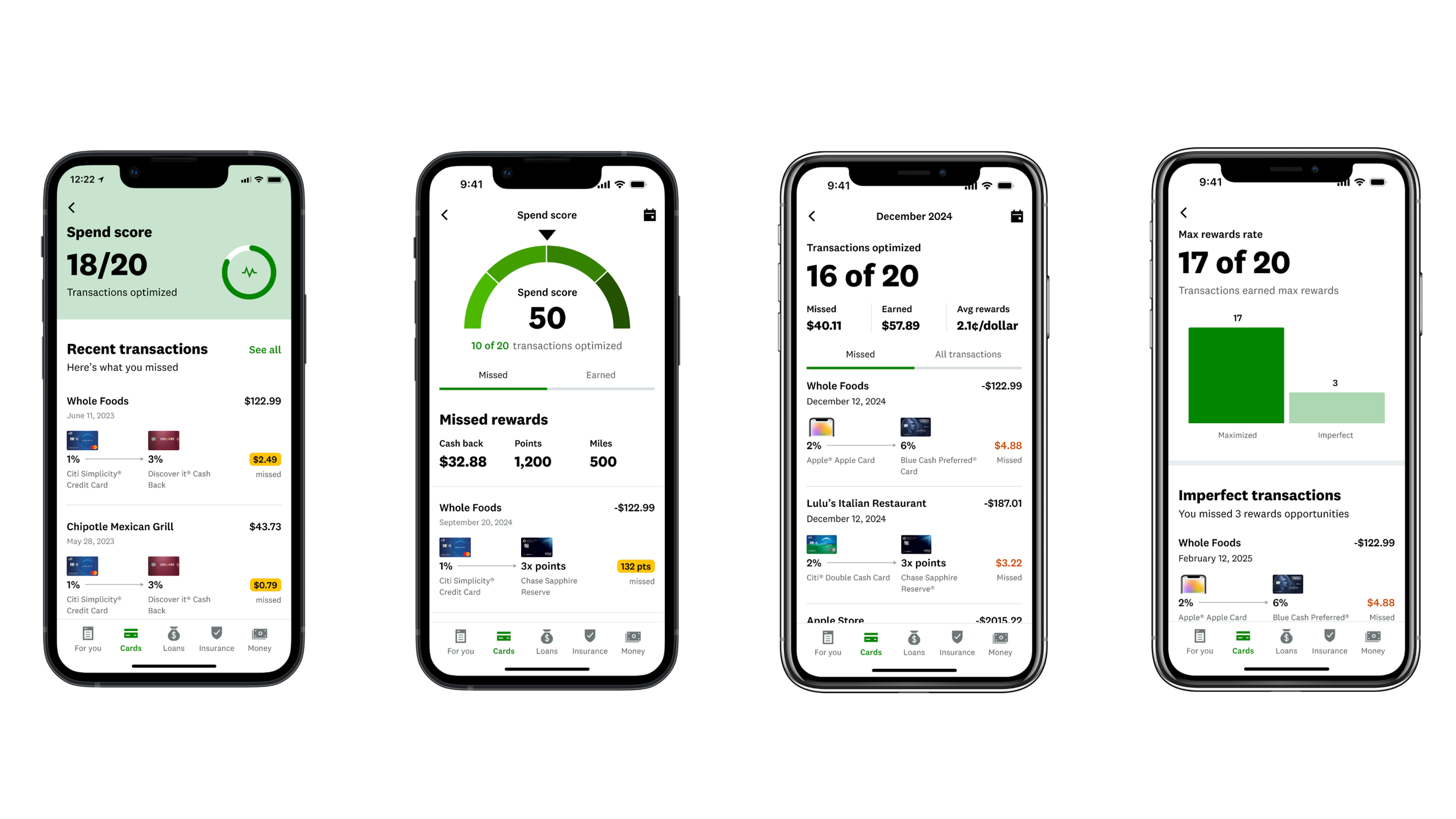

We tested these 10 concepts with members and the “Spend score” concept was the clear winner.

Concepts tested

Spend score 🏆

Reminders

Top Cards

Transactions

Subscriptions

Money Down the Drain

Best Possible Wallet

Wallet Checkup

Awards / Badges

Spending Breakdown

Developing and converging

The “missed transactions” rows resonated the most with test participants, so our main goal was to refine the “Spend score” concept further to obtain the correct framing.

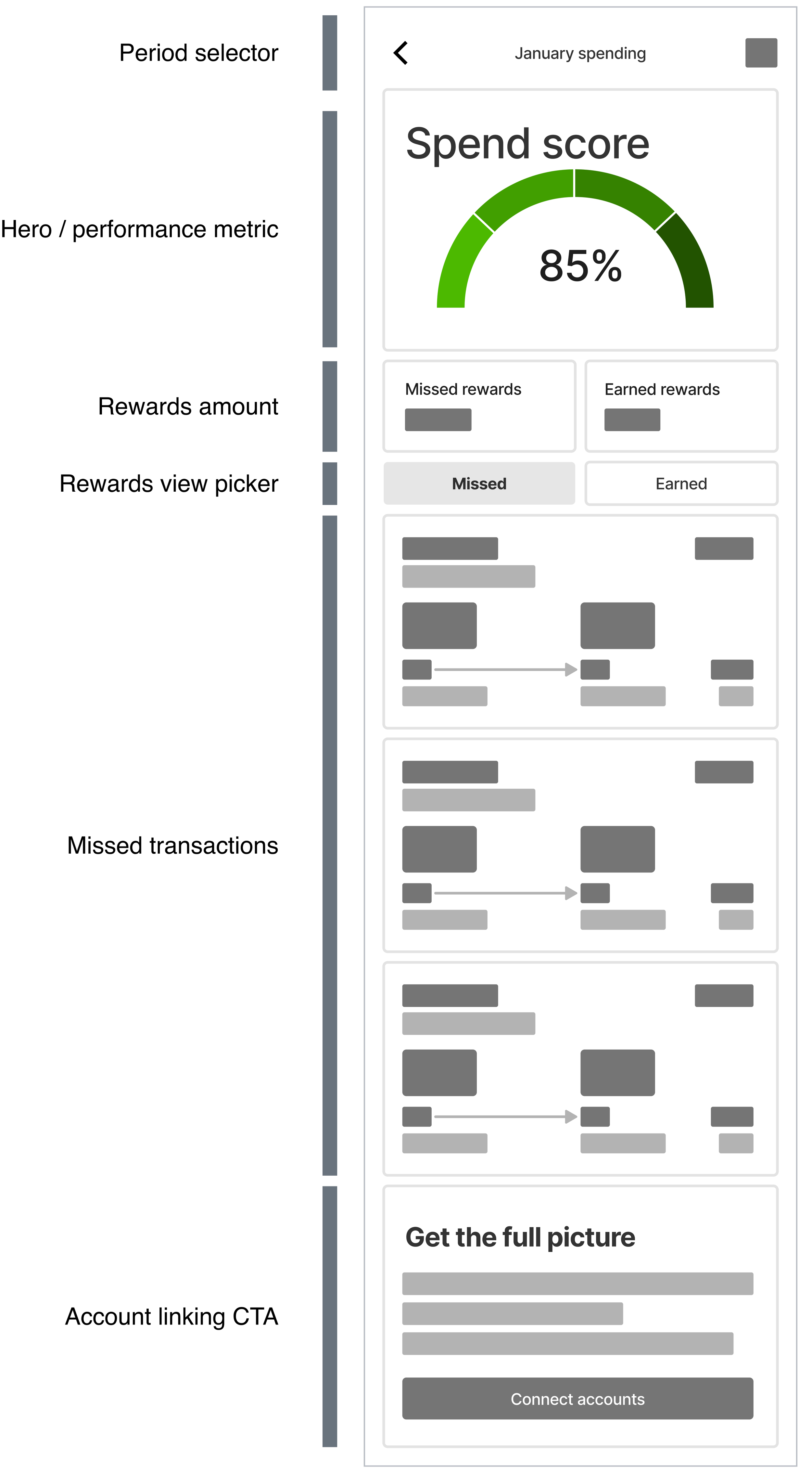

Spend score Anatomy

Month selection

Key hero metric

Missed vs earned rewards for that month

Linking call to action (most members don’t link all of their accounts)

A/B testing

I conducted A/B/C testing on the hero metric section of the page to test comprehension and desirability from members

Putting it all together

The initial release included basic history functionality

Final Designs & Scope Tradeoffs

For the initial release, we intentionally reduced scope to prioritize clarity and time-to-learn. Non-critical elements—such as dynamic data visualizations and deeper historical breakdowns—were deferred in favor of a simpler, static representation that still delivered core value.

These tradeoffs allowed us to validate demand and comprehension before investing in more complex infrastructure.

(Final mocks and interaction GIFs here)

Outcome

(Insert analytics once finalized)

Early indicators showed increased engagement among Prime members and validated rewards optimization as a meaningful entry point for this segment. Just as importantly, the work created a foundation for future iterations and deeper personalization.

Reflection

This project reinforced the value of balancing speed with intentional discovery—especially during periods of organizational change. The Credit Cards team had strong instincts and deep domain expertise, and my role was often less about generating ideas and more about creating shared understanding, narrowing focus, and helping the team make confident decisions under uncertainty.

Leveraging the collective experience of the team through design sprints, paired with continuous discovery, allowed us to move quickly without losing sight of real member needs..

Leveling Up Other Designers

As part of this work, I shared two presentations with the broader design organization:

An Introduction to Continuous Discovery

Story-Based Interviewing

These sessions helped designers—particularly those newer to discovery—adopt techniques like interview snapshots and opportunity solution trees, improving both the quality of insights and confidence in research-led decision-making..

Theme 1

Managing multiple credit cards is a barrier to opening new cards

Across all persona’s, members felt as though managing multiple credit cards was difficult and could be a barrier to opening additional credit cards.

Key challenges

Managing balances in multiple places

Paying bills on time

Keeping track of annual fees

Monitoring transactions for fraud

Coordination of finances with spouse

Opportunity

Make having multiple credit cards easy to manage

Theme 2

Maximization of current or potential credit card rewards is challenging

Across all persona’s, members felt as though they had room for improvement when it came to rewards optimization.

Members with only few cards felt confident in their rewards utilization but were aware that they’re could be better options available

Members with many cards felt as though they had enough cards but were not utilizing all of the benefits associated with their many cards

Opportunity

Provide a central place to view and utilize credit card rewards.