Introduction

LendingTree Academy is a collection of educational videos on topics like understanding your credit score, building credit, personal finances, and evaluating a loan estimate. The goal of this project was to re-think the LendingTree Academy current state, and to update the current state styles to be inline with new branding guidelines.

The Basics

The Team

Product Manager

Product Designer (me)

Engineering Lead

Content Strategist

Videographer

Creative / Marketing

My Role

UX Design

UI Design

UX Strategy

User research

Assumption testing

Design system creation

User flows

Tools Used

Figma + Figjam

Miro

UserTesting.com

The Initial Ask

Desired Business Outcome

Increase the number of monthly active users on My LendingTree

Refresh the LendingTree Academy “look-and-feel” to match the new brand standards outlined by Creative

Hypothesis

We believe that If we make LendingTree Academy available to non-authenticated consumers, and update the aesthetics and functionality to be in line with our other digital offerings, these changes will result in increased usage of LendingTree Academy and enrollments in My LendingTree.

We will know if we are successful if we see increased traffic to the LendingTree Academy home, and course pages, longer view times on the videos, and increase My LendingTree enrollments.

Measuring Success

Analytics

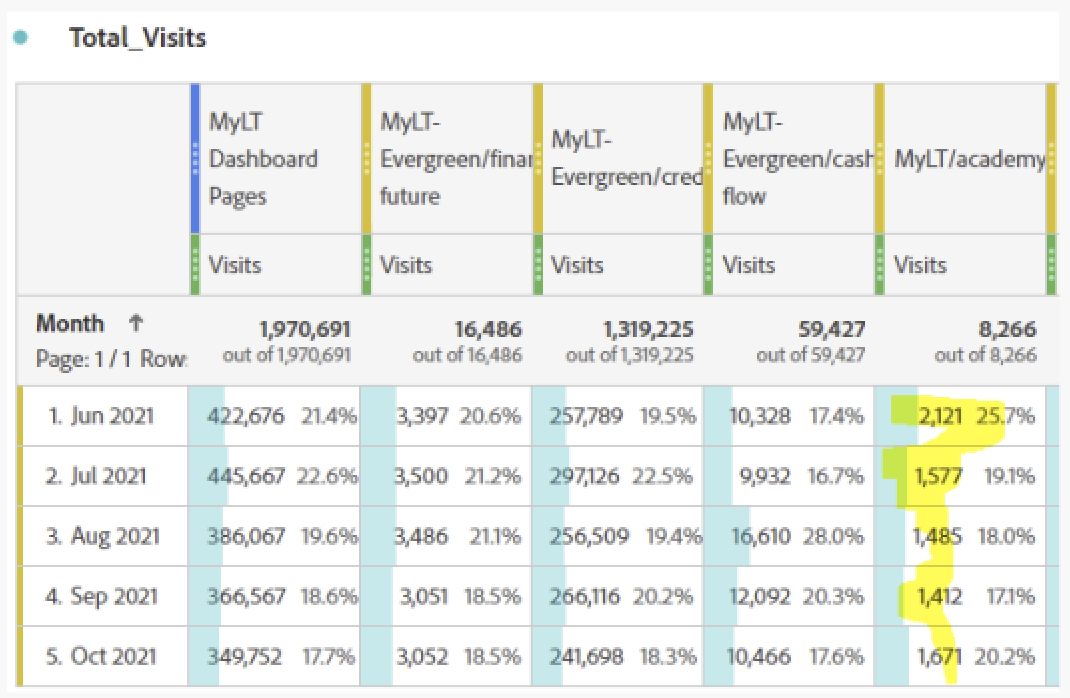

Page views for the LendingTree Academy are low compared to other pages on My LendingTree.

Key Performance Indicators

Increasing number of page visits to LendingTree Academy

Increasing sign-ups after viewing a an Academy video

Assumptions

Desirability Assumptions

People want to learn about personal finance

People will come to LendingTree to learn about personal Finance

People will create a My LendingTree account after viewing LendingTree Academy videos

Feasibility Assumptions

LendingTree can deliver content that users want to watch and find helpful

LendingTree can build an online learning platform that is as good or better than competitors

Usability Assumptions

Customers can easily use and navigate the proposed LendingTree Academy solution.

Assumption Test Questions

“In the past, where have you gone to find information or advice about personal finances?”

Have you ever used LendingTree? If so, how?

Assumption Test Results

Finding 1

Participants used a variety of tools to learn about personal finance.

Trust seemed to be most important when seeking financial advice, often this took the form of a “trusted friend.

There tended to be a general distrust of large corporations.

Participants listed social media and YouTube as a place they would go to find financial information

Finding 2

Out of the participants that recalled using LendingTree, they used LendingTree to get a sense of the market but often did not close with LendingTree.

Persona Archetypes

Builders

Builders are our consumers with little credit history. However, we have found that builders are not just young people building their credit history but also could include an older demographic. Some are immigrants that are having to “start over” and others are people that have had life change where they are transitioning from dependent to providing for for family (ex: newly single parents).

This audience is focused on finding the balance of both short and long-term planning.

Rebuilders

Rebuilders have made financial mistakes and are hiring LendingTree and other apps for help. There are two types of Rebuilders:

Type A makes the same mistake over and over. They say they want to improve their financial health but are unlikely to change habits. Apps that they gravitate towards feature warnings that alert them to “bad” spending behavior with a goal to stop the patterns. (Moneylion, Cleo, Creditwise.)

Type B owns their mistakes and are making specific tools that can “fix” their mistake. They are more likely to change behavior and try products that solve these mistakes. Rebuilders are more loyal to banks/apps they already use or a brand that helped them in the past.

Maintainers

Maintainers understand money really well and are interested in better utilization of their monthly income/expenses and are also interested in learning how to best park their savings and investments. They leverage LendingTree for research to get personalized rates but close off network. They use apps and blogs to gain confidence and may consider a financial advisor.

So far - our research is finding credit score is not a concern for this group perhaps because they are in good credit standing with higher income.

UX Strategy

Phase 1 (Now)

Update LendingTree Academy Styles to match band standards

Surface LendingTree Academy in more places around LendingTree.com

Make LendingTree Academy accessible to the public, not just My LendingTree users

Phase 2 (Later)

Partner with social media personal finance experts and invite them to teach a course on LendingTree Academy

Conduct longer-term research study around future LendingTree Academy courses

Add new features (based on customer feedback) to LendingTree Academy

Early Ideation

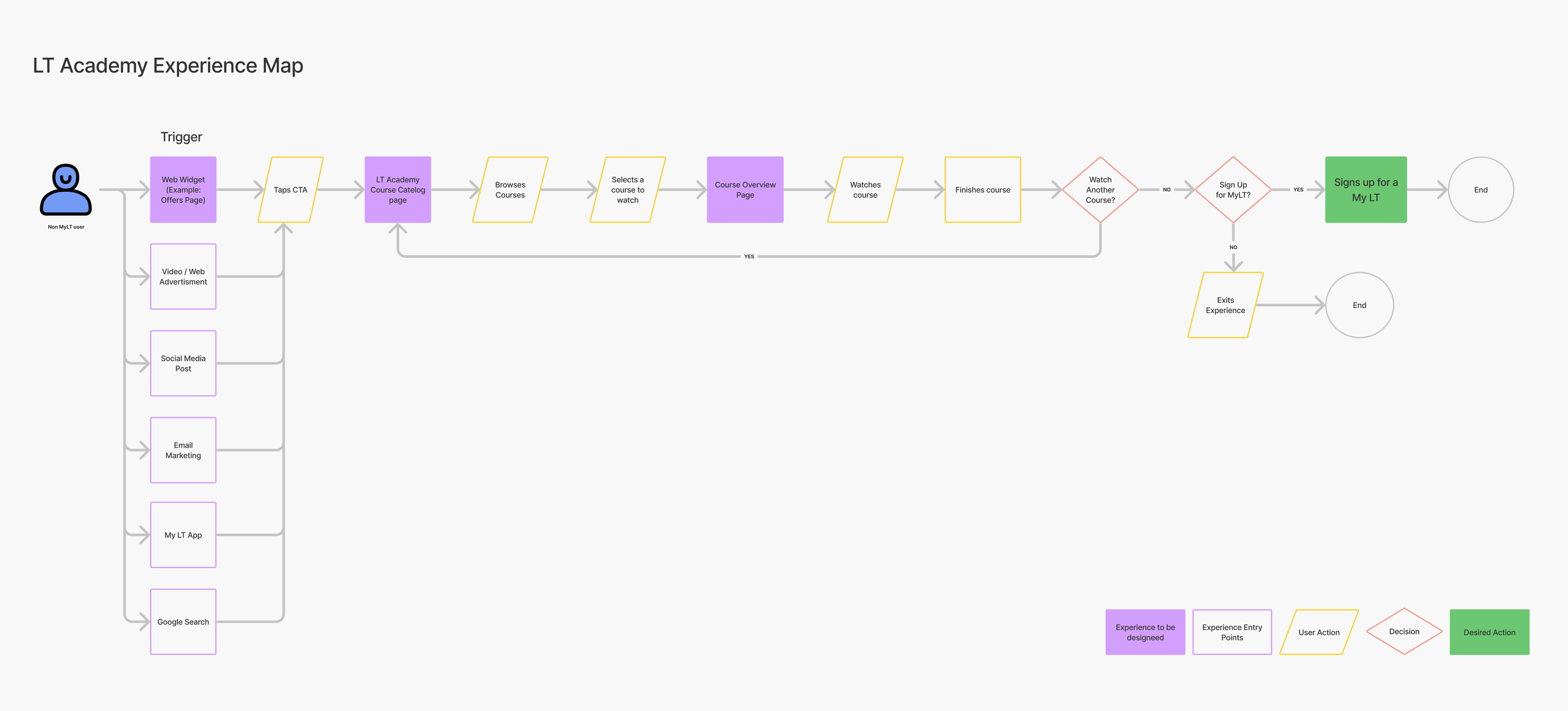

Mapping the experience

In order to externalize our thinking, we mapped out what a typical interaction would look like in our flow.

Collaboration and brainstorming with the product team allowed us to gain a shared understanding of the desired business outcome as well as the users needs, pain points, and desires.

Wireframes

Defeating the blank screen

I focused a most of my energy on the course page. Here are two options I presented to my team for feedback.

LendingTree Academy “widget”

This concept would surface LendingTree Academy components on pages throughout the LendingTree experience. The widgets would surface in key places during a flow to offer information and guidance at the right time and place (mobile would stack like other components on the page - shown in final designs).

Increasing the fidelity

Creating a Design System for LendingTree

During this same time, I led efforts on creating a design system. LendingTree had a marketing style guide and Figma libraries, but no UI specific documentation. I created this basic wireframe documentation Figma file to help designers to build the foundation of that design system. My reasoning was that it would be faster to agree on foundational elements than to audit the entire digital space. We did end up doing a UI audit, but at least all new work could built using these foundational components.

This design system work was done in collaboration with Creative and Engineering. We planned on using design tokens to map UI elements in Figma to CSS attributes.

Prototype

Prototype Results

We hypothesized that most viewers would find LendingTree Academy from a web search. This meant that the primary entryway was most likely the course page. The user could then view all, or suggested, courses from the course page.

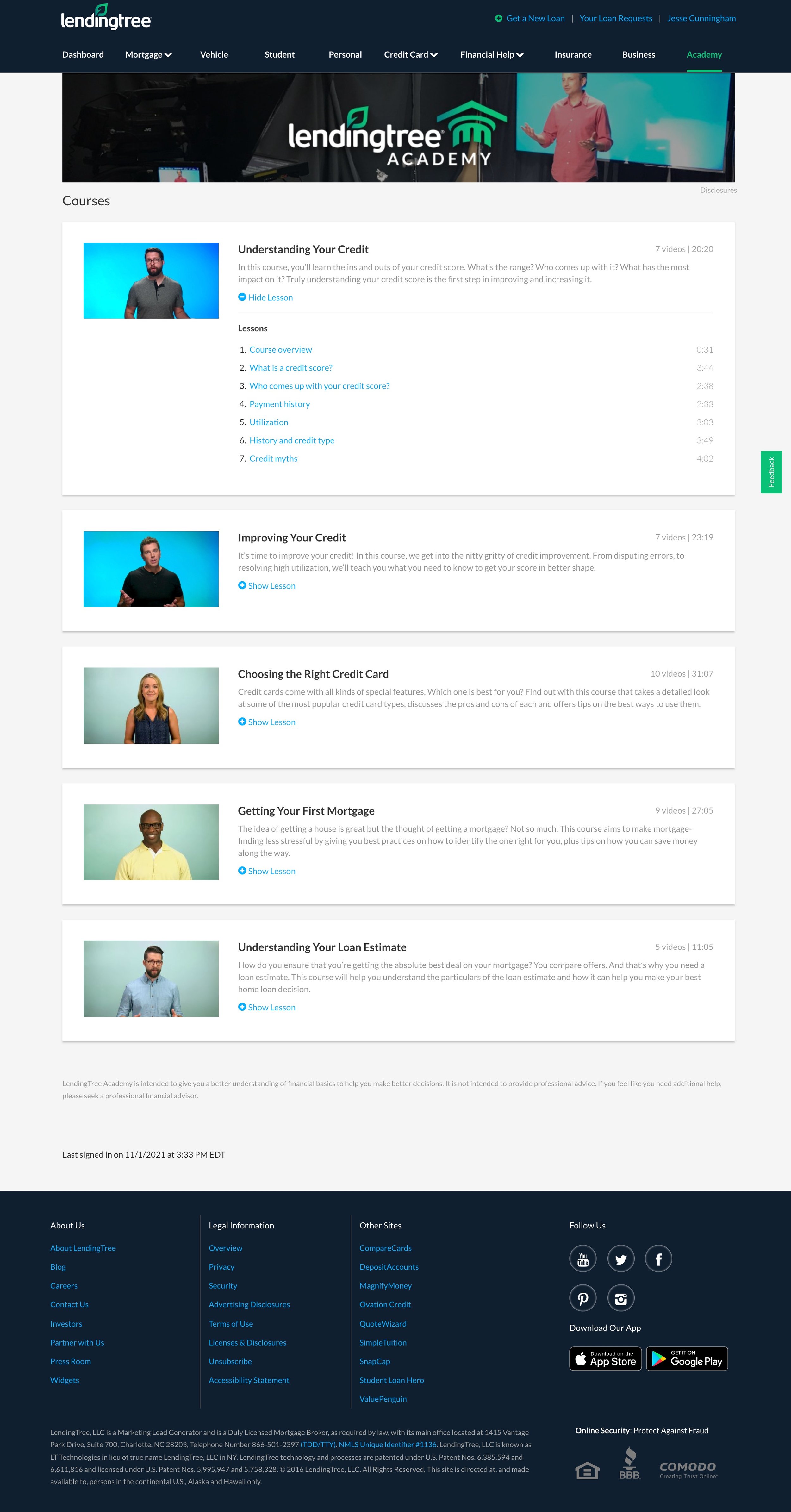

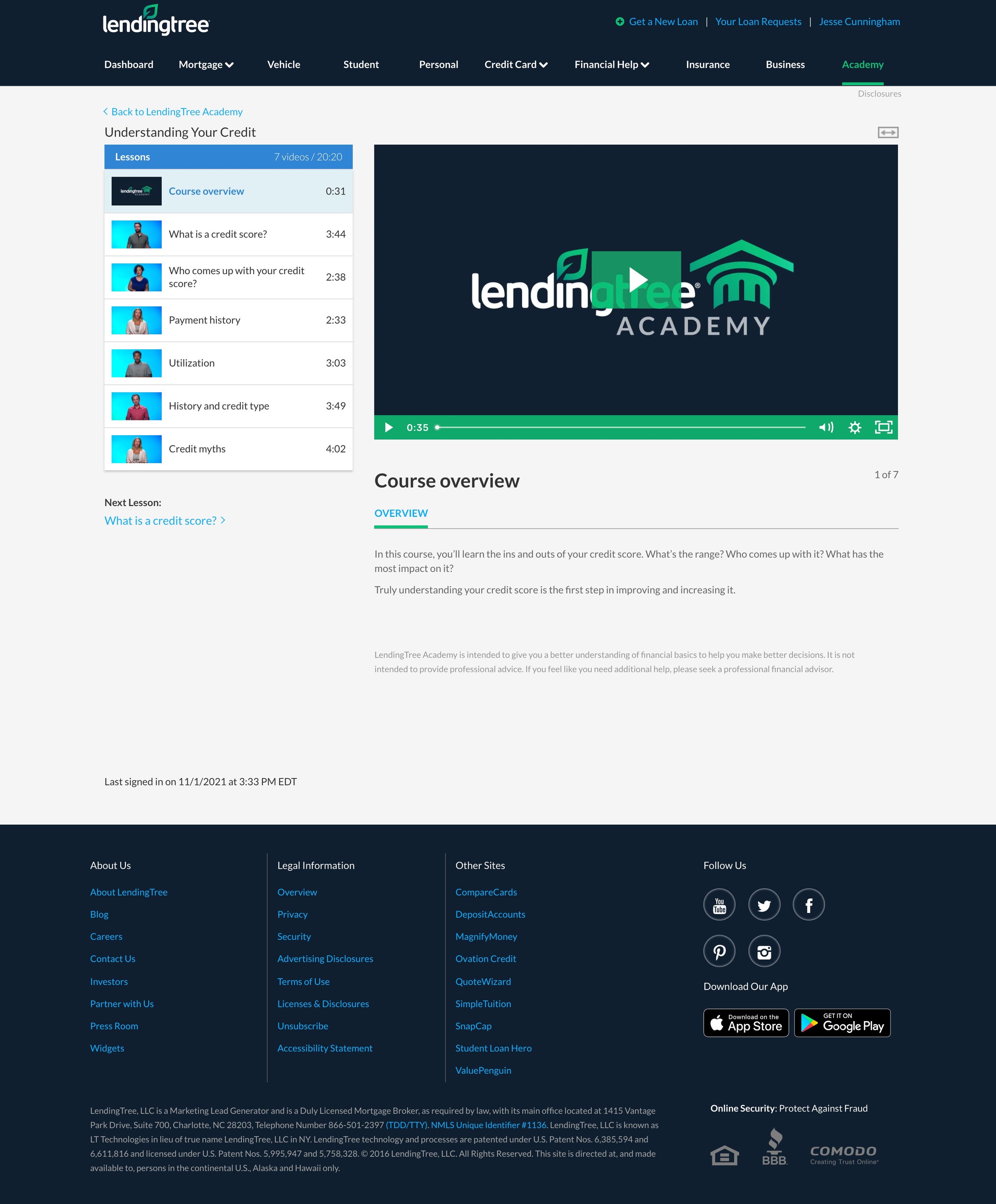

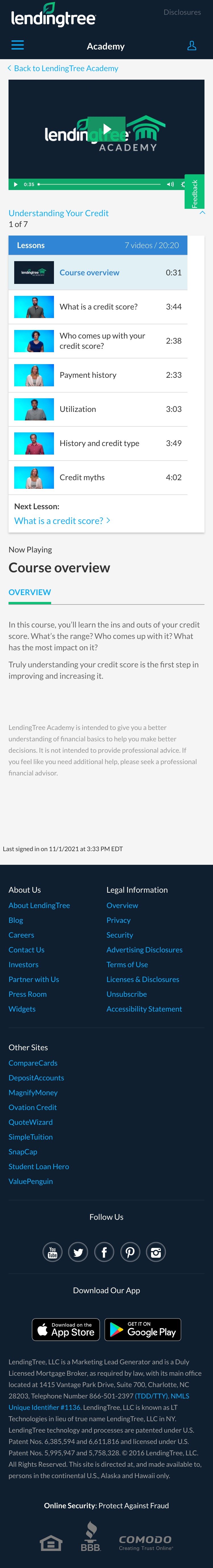

Before & After

Homepage

Before

After

Before & After - Homepage - Mobile

Before & After - Course Page

Before

After

Before & After - Course Page - Mobile

Phase 2: Planning

Next Steps

The scope of what the team could do “Now” was complete. LendingTree Academy was migrated to public web, new UI Styles were applied, and “widgets” were added to key customer touch-points in the user flow.

Content Strategy

Discussion with content strategy, budget talks for new course content, and key partnerships with social media influencers began.

Impact

Unfortunately, the project was put on hold after “phase 1” was complete. The next phase would require additional budget approvals and LendingTree did not want to commit to anything at this time.

Reflection

As I think back at this project, I wish I did more assumption and user testing. Due to time and budget constraints (as well as our contract with UserTesting was being renewed) I felt that it was safe for Phase 1 to simply do the UI enhancements and “widgets”. I would then have liked to see the analytics after these changes were made to see if we had hit the desired business outcome. While there would be multiple opportunities for the user to create a My LendingTree account, I think the real value would have come in Phase 2 when we partnered with social media influencers, and added more course content that emphasized the value of My LendingTree.